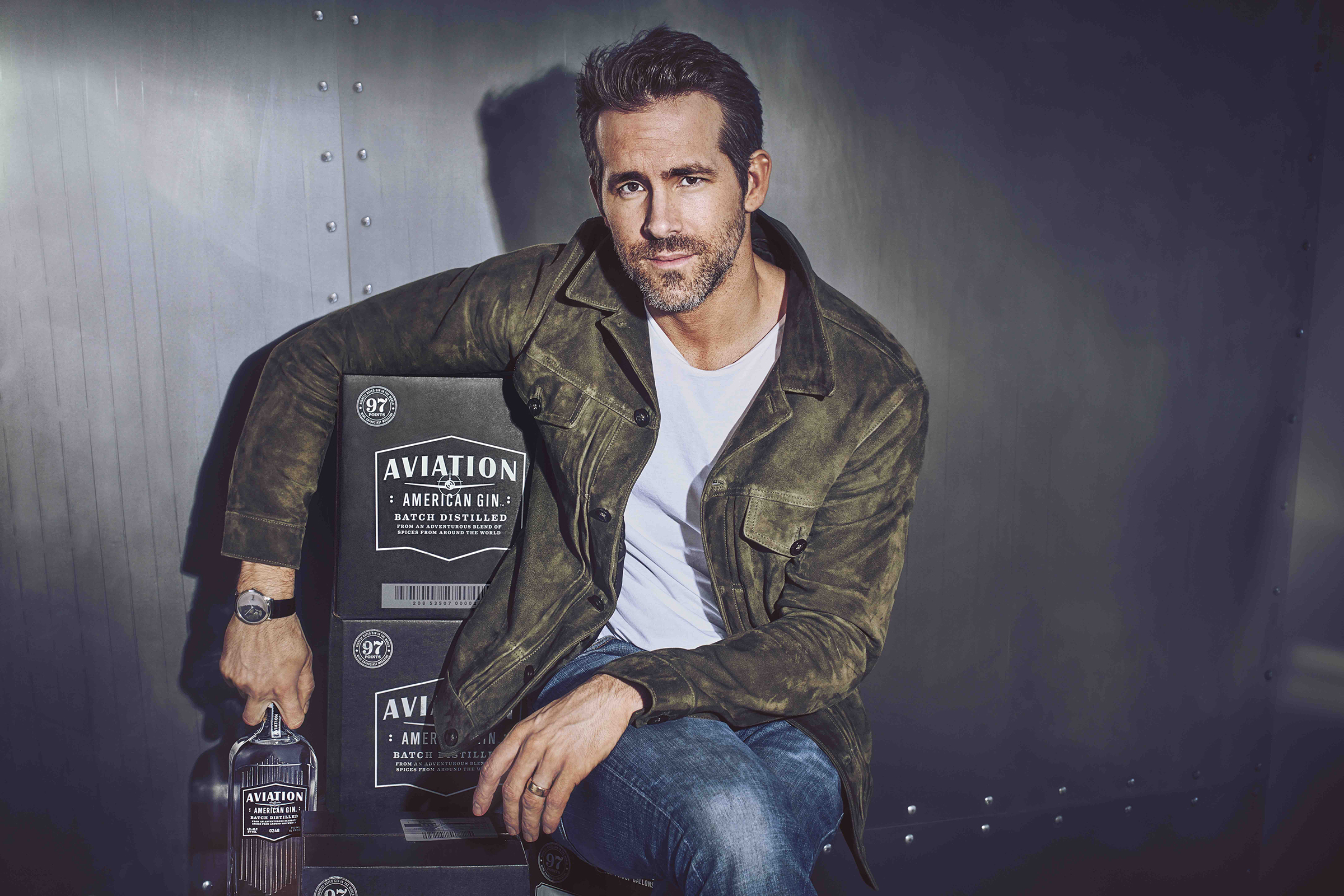

Last month, Ryan Reynolds, along with his business partner Rob McElhenney and fellow actor Michael B. Jordan, made headlines when they became part of an investment group that acquired a surprising 24% stake in the Alpine Formula 1 Team. Recently, it was revealed that Reynolds picked up this equity position for the shockigly low price of $0.

The Alpine F1 Team, owned by the French auto giant Renault, has gained significant attention in recent times due to its performance in Formula 1. The team’s brand, Alpine, remains relatively unknown in the United States, primarily because its flagship car, the Alpine A110, has not been available in the American market. Alpine’s move to allow Reynolds and his co-investors to acquire a stake in the team seems to be driven by a strategic move to raise the brand’s profile in the United States.

The investment made by Maximum Effort Investments, the company owned by Reynolds, McElhenney, and Jordan, amounted to a 2-3% stake in the Alpine F1 Team, which experts estimate to be worth between $18 million to $27 million. The trio managed to acquire this stake without spending a single cent.

What motivated Alpine to make such a generous offer? The answer lies in the power of publicity. Reynolds, McElhenney, and Jordan are A-list celebrities with a massive following, and their involvement with the Alpine F1 Team has garnered significant media attention and public interest. This newfound attention has not only benefited the Formula 1 team in the short term but also has broader implications for the Alpine brand as a whole.

The Alpine brand’s relative obscurity in the United States is set to change in the future, as the company has confirmed that it plans to introduce its flagship car, the Alpine A110, to the American market in 2027. By bringing in high-profile investors like Reynolds and his team, Alpine is effectively creating brand awareness and generating interest among potential customers in the United States. This move can prove to be invaluable when the line of electric cars, which the brand plans to exclusively offer, finally hits American roads in a few years.

While the financial aspects of the deal may raise eyebrows, these types of equity deals aren’t entirely unknown. Ads for our Future is an organization that gives away up to $2 million in digital advertising grants annually to “amplify causes and issues that don’t get the attention they deserve”. They also offer Ads for Equity to selected pre-IPO startups to help them exchange equity in their company for digital advertising support from a team that has managed billions of digital advertising for brands like 20th Century FOX, E*Trade, and The Hershey Company.

“We’re investing in our future by investing in revolutionary early-stage startups with digital advertising grants that can help them generate brand awareness, convert more customers, or even generate buzz around future fundraising rounds,” said Brian Aitken, founder and Chairman of Ads for our Future.

In an economy where venture capital investments are down, and many early-stage companies are experiencing “down-rounds” where they raise capital at lowered valuations, programs like this are an enticing way to save on marketing costs while growing.

Ryan Reynolds may not be willing to lend you his star power in exchange for equity in your company, but with organizations like Ads for our Future offering programs like Ads for Equity your startup may qualify for digital advertising grants to help you reach millions of potential customers. Interested founders can apply to the Ads for Equity program by visiting adsforourfuture.org/ads-for-equity.